Introduction to Cryptocurrency

Cryptocurrency is a digital or virtual form of currency that uses cryptography for security. Unlike traditional currencies issued by governments, cryptocurrencies operate on technology called blockchain, which is a decentralized system spread across numerous computers that manage and record transactions. This feature is a defining characteristic that ensures the integrity and security of transactional data. The inception of cryptocurrency dates back to the establishment of Bitcoin in 2009, created by an entity or individual known as Satoshi Nakamoto. Bitcoin was the first cryptocurrency to gain significant traction, and its success paved the way for the emergence of numerous other cryptocurrencies, such as Ethereum, Litecoin, and Ripple.

The fundamental principles of cryptocurrencies revolve around decentralization, security, and transparency. Transactions made with cryptocurrencies are inherently decentralized, meaning they are not controlled by a single entity or intermediary, unlike traditional financial systems that rely on central banks and financial institutions. This decentralization reduces the risk of systemic failures and corruption, as no single party holds control over the entire system.

Cryptocurrencies have a range of features that contribute to their growing prominence in the financial world. High levels of security are achieved through the use of cryptographic techniques, making it extremely difficult for transactions to be tampered with. Moreover, transparency is upheld by blockchain technology, which maintains a public ledger of all transactions, thus allowing for traceability and enhancing trust among users. Digital scarcity is another key attribute, particularly noted in Bitcoin, where a cap of 21 million coins exists, imbuing the currency with a deflationary nature.

Bitcoin and Ethereum stand out as two of the most prominent cryptocurrencies today. Bitcoin, often referred to as digital gold, is considered a store of value and a safe haven asset. Meanwhile, Ethereum distinguishes itself with its smart contract functionality, facilitating automated, self-executing agreements with the terms of the contract embedded directly in code. This innovation has broadened the potential applications of blockchain technology, fostering a robust ecosystem of decentralized applications (dApps) across various sectors.

The History and Evolution of Cryptocurrency

Cryptocurrency’s inception can be traced back to 2008 when an unknown person or group, using the pseudonym Satoshi Nakamoto, published a whitepaper titled “Bitcoin: A Peer-to-Peer Electronic Cash System.” This seminal document laid the foundation for Bitcoin, the first decentralized digital currency, and introduced the concept of blockchain technology. Bitcoin’s network went live in January 2009 with the creation of the genesis block, marking the birth of cryptocurrency.

In the years following Bitcoin’s emergence, numerous alternative cryptocurrencies, or altcoins, began to appear. Litecoin, created by Charlie Lee in 2011, was one of the earliest, designed to offer faster transaction times compared to Bitcoin. As the cryptocurrency landscape expanded, vital platforms such as Ethereum, launched by Vitalik Buterin in 2015, introduced smart contracts, which enabled the development of decentralized applications (dApps) and further expanded the utility of blockchain technology.

Several significant events have punctuated the evolution of cryptocurrency, each contributing to its growing prominence. In 2017, the Initial Coin Offering (ICO) boom saw numerous blockchain projects raise millions, albeit with mixed success and some notable scams. This period also witnessed Bitcoin reaching its then-all-time high of nearly $20,000. Regulatory scrutiny increased in response, exemplified by China’s ban on ICOs and cryptocurrency trading.

Over time, institutional interest has dramatically shaped the cryptocurrency market. The entrance of major financial players, including companies like Tesla, which announced substantial Bitcoin purchases in 2021, and the development of cryptocurrency ETFs, have lent credibility and driven adoption. Additionally, the rise of Decentralized Finance (DeFi) platforms and the Non-Fungible Token (NFT) craze further diversified the applications of blockchain technology.

As the cryptocurrency landscape continues to evolve, it is marked by its innovative spirit and the relentless pursuit of decentralization. While the journey has been turbulent, each milestone underscores the enduring influence of cryptocurrency in the financial world and beyond.

Understanding Blockchain Technology

Blockchain technology serves as the fundamental infrastructure upon which cryptocurrencies are built. At its core, a blockchain is a decentralized ledger that records transactions across multiple computers, known as nodes. This distributed nature ensures that no single entity has control over the entire network, thus enhancing security and transparency.

A blockchain is composed of a series of blocks, each containing a list of transactions. Each block is linked to the previous one through cryptographic hashes, forming a chain of blocks—hence the name “blockchain.” When a new transaction is made, it first needs to be verified and then added to a new block. The process of adding a new block to the blockchain is called mining, accomplished through a consensus algorithm. The most commonly employed consensus algorithms include Proof of Work (PoW) and Proof of Stake (PoS). Consensus algorithms are designed to achieve agreement on the blockchain’s state among distributed nodes, ensuring the integrity and accuracy of the ledger.

The benefits of blockchain technology are manifold. Firstly, its decentralized nature eliminates the need for intermediaries, thereby reducing the cost and time associated with transactions. Secondly, the security features embedded in blockchain, such as cryptographic hashing and consensus algorithms, make it highly resistant to fraud and tampering. Additionally, blockchain offers unparalleled transparency; all transactions are recorded in a public ledger, allowing for easy auditing and traceability.

Another significant advantage is the immutability of the ledger. Once data is written onto a blockchain, it is virtually impossible to alter it without the consensus of the majority of the network’s nodes. This ensures the reliability and permanence of information, which is particularly beneficial for applications requiring trustworthy records.

Understanding the mechanics of blockchain technology demystifies the complex systems behind cryptocurrencies. It forms the backbone that enables not just digital currencies but a multitude of applications across various industries, from finance to supply chain management, healthcare, and beyond. This foundational technology holds the promise of reshaping how we interact with digital assets in the near future.

How Cryptocurrencies Work

At their core, cryptocurrencies operate through a decentralized ledger technology known as blockchain. To understand this better, we need to look at several key components: mining, wallets, public and private keys, and transaction verification.

Mining is a process by which transactions are validated and added to the blockchain. Miners use powerful computers to solve complex cryptographic puzzles. These puzzles are computationally intensive, ensuring security and integrity across the network. When a miner successfully solves a puzzle, they are allowed to add a new block to the blockchain and are rewarded with a certain amount of cryptocurrency.

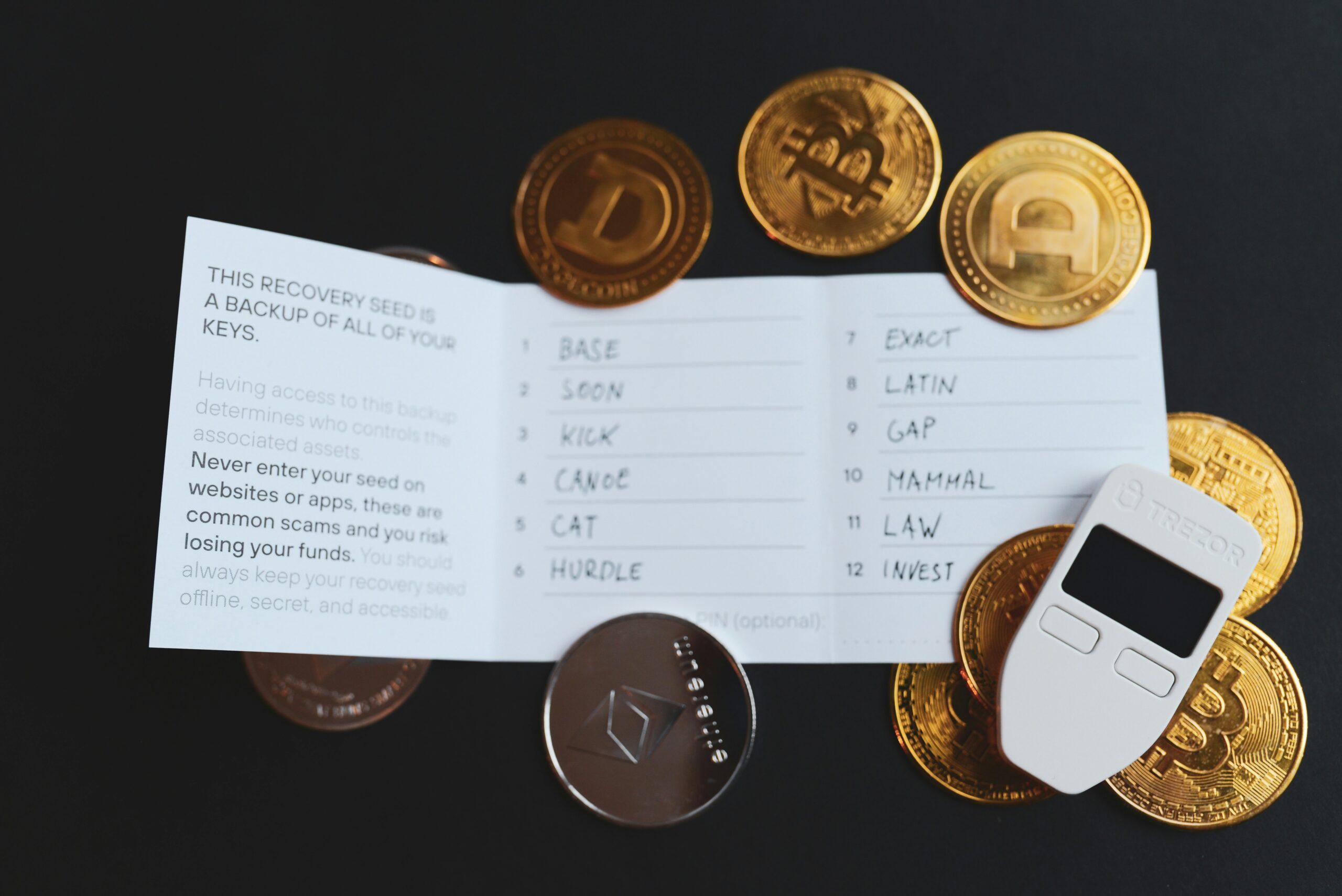

Wallets are digital tools used to store and manage cryptocurrencies. Each wallet contains a pair of cryptographic keys: a public key and a private key. The public key acts like an address that can be shared with others to receive cryptocurrency. Conversely, the private key is a secure, secret number that enables the owner to access and control their funds. Losing the private key means losing access to the cryptocurrency stored in that wallet.

When a transaction is initiated, the sender uses their private key to sign a message that includes the transaction details. This signed message is then broadcasted to the network, where nodes (computers on the network) verify the authenticity of the transaction using the sender’s public key. Verification involves confirming that the sender has sufficient funds and that the private key matches the public key. Once validated, the transaction is bundled with others into a block and added to the blockchain through the mining process.

Overall, this method of cryptographic verification and decentralized ledger maintenance eliminates the need for centralized authorities such as banks. It ensures transparency, security, and immutability, making cryptocurrencies a powerful alternative to traditional financial systems.

Types of Cryptocurrencies

Cryptocurrencies represent a rapidly evolving segment of the digital economy, characterized by a diverse array of different types. Foremost among these is Bitcoin, often referred to as “digital gold.” Since its inception in 2009 by the mysterious Satoshi Nakamoto, Bitcoin has set the precedent for all subsequent cryptocurrencies. Its primary use case is as a store of value and an alternative to traditional fiat currencies. The decentralized nature and finite supply of Bitcoin contribute substantial value, ensuring its prominent position in the market.

Next in influence is Ethereum. Launched in 2015 by Vitalik Buterin, Ethereum differentiates itself with the ability to support smart contracts. These self-executing contracts, stored on the blockchain, facilitate transactions without the need for an intermediary. This feature has fostered a burgeoning ecosystem of decentralized applications (dApps) and has positioned Ethereum as more than just a currency, but rather a foundational layer for Web 3.0 development.

Litecoin, created by Charlie Lee in 2011, is often considered the silver to Bitcoin’s gold. Its primary differentiation lies in its faster block generation times and a different cryptographic algorithm called Scrypt. These features result in quicker transaction confirmations, making Litecoin suitable for smaller, everyday transactions.

In addition to these well-established cryptocurrencies, the market has witnessed the emergence of numerous new entrants. For instance, Cardano aims to provide a more balanced and sustainable ecosystem for cryptocurrencies through a research-driven approach and a secure, scalable platform. Similarly, Polkadot introduces interoperability between different blockchains, allowing diverse networks to exchange information and value seamlessly.

The cryptocurrency ecosystem continues to grow, with each type offering unique features and potential use cases. From digital currencies acting as a medium of exchange to complex platforms enabling advanced technological solutions, the landscape is both broad and dynamic, catering to various needs and industries.

The Impact of Cryptocurrency on the Financial Landscape

Cryptocurrencies have progressively reshaped the traditional financial system, introducing several transformations that extend beyond mere payment methods. One of the most significant impacts is through decentralized finance (DeFi). DeFi exemplifies a paradigm shift by enabling financial transactions without intermediaries such as banks. Utilizing smart contracts on blockchain networks, DeFi platforms offer services like lending, borrowing, and trading with high efficiency and reduced costs.

The banking sector has not remained unaffected by the rise of cryptocurrencies. Traditional banks face increasing competition from crypto-based services which provide seamless, faster, and often cheaper alternatives. The ability for cryptocurrencies to transfer value globally 24/7 without the need for traditional banking hours has particular relevance in international trade. Businesses can conduct cross-border transactions swiftly and transparently, reducing the reliance on foreign exchange brokers and minimizing transaction fees.

Financial inclusion is another area where cryptocurrencies demonstrate substantial potential. By leveraging blockchain technology, individuals in regions with limited access to banking services can manage and transfer assets securely. This is especially valuable in developing countries where traditional banking infrastructure may be underdeveloped or inaccessible. Cryptocurrencies facilitate financial empowerment by providing unbanked populations with tools for economic participation.

However, the integration of cryptocurrencies into the financial sector also presents challenges. Regulatory uncertainty remains a significant hurdle. Governments and financial regulators around the world are grappling with how to oversee and control the rapid growth of cryptocurrencies. Issues such as money laundering, tax evasion, and investor protection need robust regulatory frameworks to ensure a balanced approach that fosters innovation while safeguarding public interests.

The volatility of cryptocurrency markets also poses risks. The value of assets can fluctuate dramatically within short periods, which can lead to financial instability. Moreover, the lack of consumer protections in some crypto transactions can leave users vulnerable to fraud and cyber-attacks.

In conclusion, while cryptocurrencies offer numerous opportunities to enhance the financial landscape, it is vital to address the challenges to ensure sustainable and secure integration into the broader financial ecosystem.

Regulatory Perspectives on Cryptocurrency

Across the globe, the regulatory approach to cryptocurrencies varies significantly. Some nations have embraced the innovation with open arms, fostering environments that encourage blockchain development and cryptocurrency adoption. For instance, countries like Switzerland and Malta have established clear regulatory frameworks to provide legal certainty and promote investment in the cryptocurrency sector. Their supportive policies are designed to balance innovation with consumer protection, encouraging technological advancement while maintaining a stable financial environment.

In contrast, other countries have adopted stringent measures to limit or outright ban the use of cryptocurrencies. China, for example, has implemented severe restrictions on cryptocurrency trading and initial coin offerings (ICOs), citing concerns over financial stability, fraud, and capital outflow. Similarly, India’s regulatory stance has fluctuated from restrictive to cautiously optimistic, reflecting the complexities of integrating cryptocurrencies into traditional financial systems.

The disparity in regulatory perspectives is also evident among international regulatory bodies. The Financial Action Task Force (FATF) has called for worldwide cooperation to address the potential risks associated with cryptocurrencies, emphasizing the need for robust Anti-Money Laundering (AML) and Combating the Financing of Terrorism (CFT) measures. At the same time, the European Union is working on the Markets in Crypto-Assets (MiCA) regulation, aiming to create a unified legal framework to ensure both innovation and stability in the crypto market.

Regulation plays a crucial role in safeguarding consumers and maintaining financial system stability. Key legal issues encompass fraud prevention, compliance with tax obligations, and the protection of investors and consumers from malicious activities. Proper regulatory frameworks can mitigate risks such as market manipulation, scams, and illicit activities, fostering trust and confidence among users and investors.

The evolving regulatory landscape poses both challenges and opportunities for the cryptocurrency industry. While stringent regulations may stifle innovation and drive activities underground, well-balanced and clear regulatory policies can enhance the legitimacy of cryptocurrencies, encouraging wider acceptance and integration into the global financial system.

The Future of Cryptocurrency and Blockchain Technology

As we look to the future, the cryptocurrency and blockchain landscape appears poised for significant evolution. Experts across industries are increasingly recognizing the potential of these technologies to disrupt conventional paradigms and facilitate innovative applications. One of the most frequently discussed areas is the expansion of blockchain beyond financial services into sectors like supply chain management and digital identity.

In the realm of supply chain management, blockchain technology promises unparalleled transparency and efficiency. By enabling real-time tracking of goods and immutable record-keeping, blockchain can significantly reduce fraud, errors, and delays in logistics. Companies are already piloting projects to trace the journey of products from origin to consumer, ensuring authenticity and quality.

Digital identity is another area ripe for blockchain innovation. Current identity verification processes are often cumbersome and insecure. Blockchain can offer a more streamlined and secure approach by providing individuals with a decentralized digital identity. This could simplify processes such as opening bank accounts, applying for jobs, or accessing government services, while simultaneously protecting against identity theft and fraud.

Technological advancements are also expected to address current limitations of blockchain, such as scalability and energy consumption. Emerging solutions like sharding and proof-of-stake consensus mechanisms are being developed to enhance blockchain networks’ capacity and reduce their environmental impact. These advancements will make blockchain technology more viable for widespread use across various industries.

Moreover, the integration of blockchain with other cutting-edge technologies like the Internet of Things (IoT) and Artificial Intelligence (AI) is anticipated to catalyze further innovations. In a connected ecosystem where devices communicate seamlessly and data is autonomously validated and stored, blockchain could act as the backbone, ensuring data integrity and security.

In conclusion, while the future of cryptocurrency and blockchain technology is still being written, the potential applications and technological advancements on the horizon suggest a transformative impact across multiple sectors. As we continue to navigate this evolving landscape, staying informed and adaptable will be key to leveraging these technologies for societal and economic benefit.

Auto Amazon Links: No products found.