Introduction to LLCs in Vermont

Limited Liability Companies (LLCs) have gained significant popularity among entrepreneurs in Vermont due to their structural advantages and operational flexibility. An LLC is a distinct entity that establishes a legal separation between the business and its owners, providing them with personal liability protection. This means that, in the event of financial troubles or lawsuits, personal assets of the members are safeguarded from business-related liabilities. This feature is often one of the primary reasons why business owners opt for LLC formation in Vermont.

Another compelling reason for choosing an LLC in Vermont is the tax flexibility it offers. Unlike traditional corporations that face double taxation—where income is taxed at both the corporate and personal levels—LLCs provide the option to elect how they want to be taxed. By default, an LLC is treated as a pass-through entity, meaning that its profits and losses are reported on the owners’ personal tax returns, thus avoiding the corporate tax burden. This taxation method can be particularly advantageous for small business owners, allowing them to optimize their tax liabilities effectively.

Additionally, LLCs in Vermont are known for their ease of management and less stringent compliance requirements compared to corporations. There is no obligation for formal meetings or extensive record-keeping, which can streamline the operational aspects of running a business. This is especially appealing for entrepreneurs who may be new to the business landscape or those managing smaller enterprises. Overall, these benefits make forming an LLC in Vermont an attractive option for those looking to establish a business with a clear structure, significant protection, and flexibility in management and taxation.

Benefits of Forming an LLC in Vermont

Establishing a Limited Liability Company (LLC) in Vermont presents numerous advantages for entrepreneurs and business owners seeking to protect their assets while enjoying the benefits of a flexible business structure. One of the primary benefits of forming an LLC in Vermont is personal asset protection. This legal structure ensures that the personal assets of owners, also known as members, are safeguarded from business debts and liabilities. In cases of lawsuits or financial obligations, only the assets of the LLC itself are typically at risk, providing peace of mind to its members.

Additionally, Vermont offers a favorable tax environment for LLCs. Unlike many states, Vermont does not impose a corporate income tax on LLCs. Instead, members report their earnings on their personal tax returns, avoiding double taxation that is often faced by corporations. This single-layer taxation structure enhances the financial appeal of forming an LLC in Vermont, allowing business owners to retain more of their profits. Furthermore, the state’s ongoing commitment to supporting small businesses translates into a simpler tax compliance process, providing additional incentives for LLC formation.

Another significant benefit of registering an LLC in Vermont is the credibility it lends to a business. Operating under an official entity not only enhances the legitimacy of the business in the eyes of customers and vendors but also fosters greater trust from potential investors. An LLC designation communicates to stakeholders that the business adheres to regulatory standards and takes its operations seriously.

Moreover, Vermont’s business-friendly environment offers resources and support networks designed to facilitate the growth of small businesses. The state’s economic development initiatives and access to local business organizations create ample opportunities for networking and collaboration, further benefitting LLCs. The combination of personal asset protection, tax advantages, credibility, and a supportive business landscape makes Vermont an appealing choice for those considering LLC formation.

Understanding the Vermont Business Environment

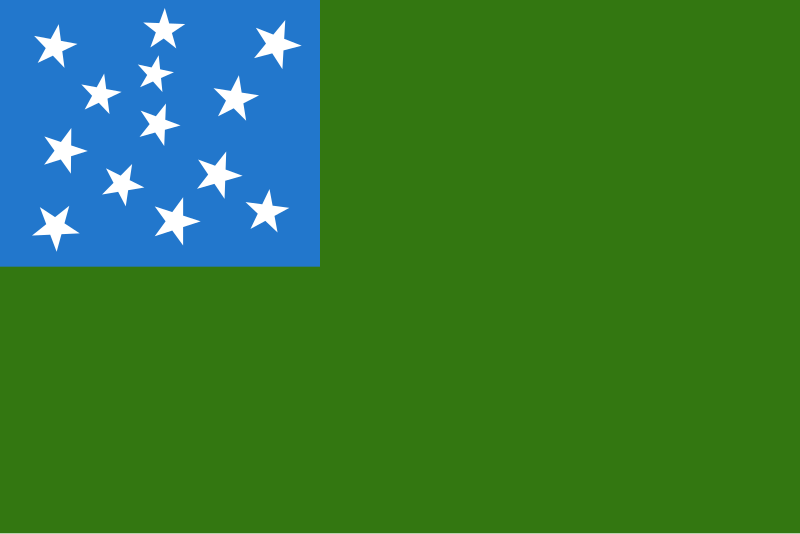

Vermont, renowned for its picturesque landscapes and vibrant communities, also possesses a dynamic economic landscape that presents numerous opportunities for entrepreneurs and small business owners. The state’s economy is characterized by several key industries, including tourism, agriculture, manufacturing, and renewable energy. Each of these sectors plays a crucial role in influencing the overall economic health and business environment of Vermont.

Tourism is one of the most significant contributors to Vermont’s economy, attracting visitors year-round to its mountains, lakes, and charming towns. The hospitality sector supports a plethora of businesses, ranging from accommodations to restaurants and outdoor recreation companies. Additionally, Vermont’s agricultural industry, particularly dairy farming and craft food production, showcases the state’s commitment to local resources and sustainability, which is increasingly appealing to consumers.

Manufacturing, although less prominent than in previous decades, continues to provide employment and innovative products, notably in specialized niches such as woodworking and machinery. Moreover, Vermont’s emphasis on renewable energy offers burgeoning opportunities in related industries, reflecting the state’s dedication to environmental stewardship and economic viability.

A vital aspect of supporting new businesses in Vermont is the collaboration between the Vermont Secretary of State and the Department of Taxes. These institutions serve as key resources by providing essential information and guidance for business formation, compliance, and operational continuity. Entrepreneurs can find valuable assistance in navigating the legal requirements of establishing an LLC, understanding tax obligations, and accessing available state resources designed to foster growth and sustainability.

Through a combination of diverse industries and supportive governmental agencies, the Vermont business environment creates a robust framework for entrepreneurs. With proper guidance and strategic planning, new ventures can thrive in this unique and enriching economic landscape.

LLC Naming Requirements in Vermont

Choosing a name for your Limited Liability Company (LLC) in Vermont is a crucial step in the formation process, as it identifies your company and must adhere to specific regulations. The name you select must be distinguishable from existing business entities already registered in Vermont, which is fundamental for ensuring clarity and avoiding market confusion. To confirm name availability, it is advisable to conduct a name search through the Vermont Secretary of State’s business entity database. This online resource allows potential business owners to check for similarities with existing entities and assess compliance with state naming regulations.

Additionally, any business name registered in Vermont must include a specified suffix. For LLCs, acceptable suffixes include “Limited Liability Company,” “LLC,” or “L.L.C.” Utilization of these suffixes is mandatory and serves to communicate the company’s limited liability status to customers and other stakeholders. Failing to include one of these suffixes could lead to complications with registration approval.

Moreover, certain words are prohibited when naming an LLC in Vermont. The use of terms that may imply a connection to government agencies or regulatory bodies, such as “FBI” or “Treasury,” is strictly forbidden. Similarly, words that can mislead the public about the nature of your business or imply action as a financial institution or insurer are also prohibited. To ensure compliance, business owners should exercise caution and consider the perceptions their names may evoke.

Ultimately, selecting a unique and compliant name for your Vermont LLC can set a solid foundation for your business. Consider brainstorming several name options and consulting with a legal professional or business advisor who can provide further guidance on the naming process.

Filing Articles of Organization

In the process of forming a Limited Liability Company (LLC) in Vermont, one of the key steps is the filing of Articles of Organization. This document serves as the official formation document required by the Vermont Secretary of State to establish an LLC legally. The Articles of Organization outline essential details about the LLC and its structure, ensuring that the entity is recognized by the state.

To initiate the filing process, an applicant must complete the Articles of Organization form, which is available online through the Vermont Secretary of State’s website or can be obtained in-person at their office. The filing can be accomplished electronically or through a traditional paper submission. If choosing the online method, applicants will find it convenient, as the process is streamlined and offers instant confirmation upon submission.

The specific information required in the Articles of Organization includes the LLC’s name, which must be unique and compliant with state guidelines, the address of the LLC’s principal office, and the name and address of the registered agent who will serve as a point of contact for legal documents. Additionally, the Articles must include an indication of whether the LLC will be managed by its members or by appointed managers. Lastly, the signature of the individual forming the LLC is necessary to validate the document. Ensuring that all information is accurate and complete is crucial, as any errors could lead to delays in processing.

Once the Articles of Organization are filed, the entity will receive a confirmation, usually within a few business days, thus officially marking the formation of the LLC in Vermont. It is advisable to keep a copy of the filed documents for your records and future reference.

Filing Fees and Payment Methods

When forming a Limited Liability Company (LLC) in Vermont, one of the primary considerations is the cost associated with filing the Articles of Organization. The state imposes a filing fee that varies depending on the filing method. As of 2023, the standard fee for submitting the Articles of Organization online is $125, while the fee for filing by mail is $150. This distinction underscores the potential savings associated with opting for the electronic submission of documents.

In addition to the initial filing fees, it is essential to anticipate any supplementary costs that may arise during the formation process. For instance, if you choose to expedite your filing, there may be an additional charge, which is typically around $50. Such options are beneficial for entrepreneurs looking to establish their business quickly and efficiently. Another consideration is the cost of reserving a business name, which is an optional but recommended step prior to filing the Articles of Organization. The name reservation fee in Vermont is $20, allowing you to secure your desired business name for a period of 120 days.

Payment methods for the filing fees are straightforward. Vermont accepts various forms of payment, including credit cards and checks. When filing online, you can conveniently pay using a credit card at the time of submission. Conversely, if you are filing by mail, you should include a check made payable to the “Vermont Secretary of State.” It is imperative to ensure that payments are processed promptly to avoid delays in the LLC formation process. By understanding these fees and payment methods, entrepreneurs can better prepare for the financial aspects of their Vermont LLC formation journey.

Creating an Operating Agreement

While Vermont law does not mandate LLCs to have an operating agreement, drafting one is highly advisable for a variety of reasons. An operating agreement serves as a foundational document that outlines the internal workings of the LLC, establishes the ownership structure, and delineates the responsibilities of its members. By creating this agreement, members can prevent potential disputes and ensure clarity regarding their rights and obligations.

Key components to include in an operating agreement encompass several essential aspects. Firstly, the agreement should specify the ownership percentages of each member, which helps to establish control over decision-making processes. Additionally, it should describe the procedures for adding or removing members, ensuring a smooth transition should changes in membership occur.

An important section of the operating agreement addresses the management structure of the LLC. Whether the LLC will be member-managed or manager-managed is an essential detail, as it defines who holds the authority to make business decisions. This clarity can enhance operational efficiency and reduce potential conflicts. Furthermore, outlining the decision-making process, including voting rights and required majorities for specific actions, is a crucial element that fosters transparency among members.

Another critical component is financial matters, which should detail the methods for profit distribution, capital contributions, and handling losses. Additionally, including provisions regarding dispute resolution mechanisms can be beneficial in mitigating conflicts that may arise among members. By incorporating these key components, a well-crafted operating agreement can significantly contribute to the LLC’s success.

Overall, even though Vermont does not require an operating agreement, taking the initiative to create one is a prudent strategy that can offer clarity, protection, and guidance for the LLC and its members.

Obtain an EIN from the IRS

Obtaining an Employer Identification Number (EIN) is a crucial step for any Limited Liability Company (LLC) operating in Vermont. The EIN, also known as a Federal Tax Identification Number, serves as a unique identifier for your business, similar to how a Social Security number identifies an individual. It is essential for various activities, including hiring employees, opening a business bank account, and filing tax returns.

To apply for an EIN from the IRS, follow these steps: first, ensure that your LLC is officially registered with the state of Vermont, as an EIN cannot be obtained without an established business entity. After confirming registration, visit the official IRS website and access the EIN application form, known as Form SS-4.

When completing the form, you will need to provide pertinent information about your LLC, including the legal name, physical address, and the nature of your business. Designate a responsible party who will oversee the application process. This individual must be a person associated with the LLC, such as a member or manager. It’s important to note that an EIN is mandatory if your LLC plans to hire employees, operates as a corporation or partnership, or meets certain tax criteria.

Once the form is filled out, you can submit it online, by fax, or by mail. The online application process is the fastest, and you will receive your EIN immediately upon completion. If you opt to apply by fax or mail, please allow several weeks for processing. Remember that obtaining an EIN is free of charge, but it is an essential responsibility to ensure compliance with federal tax regulations.

In conclusion, acquiring an EIN is a pivotal step in the formation and operation of your Vermont LLC, enabling you to meet both legal and financial obligations effectively.

Registering for State Taxes in Vermont

When forming a Limited Liability Company (LLC) in Vermont, it is crucial to understand the tax registration process that is unique to the state. This process not only involves sales tax but may also include employer taxes and various local tax registrations. Adherence to the tax obligations set forth by the Vermont Department of Taxes is essential for ensuring compliance and maintaining good standing for the LLC.

First and foremost, if your LLC plans to sell tangible goods or certain services, it is necessary to register for a Sales and Use Tax account with the Vermont Department of Taxes. The current general sales tax rate in Vermont is 6%, with the potential for additional local taxes depending on specific municipalities. It is important to note that sales tax must be collected from customers at the point of sale, and LLCs must remit this tax on a monthly or quarterly basis, as determined by the state’s guidelines.

In addition to sales tax, if your LLC will be hiring employees, you are required to register for Employer Taxes. This includes collecting and remitting withholding tax on employee wages, as well as contributing to the Vermont Unemployment Insurance program. To facilitate this, the LLC must obtain an Employer Identification Number (EIN) from the Internal Revenue Service (IRS) and a Vermont Withholding Account from the Department of Taxes.

Furthermore, some LLCs may face local tax obligations, which vary by municipality. It is advisable to consult with local tax authorities to ensure that all necessary registrations are on record. Proper registration not only ensures compliance with state and local regulations but also provides essential legal safeguards for your LLC. Keeping accurate records and being proactive about tax obligations can ultimately lead to a smoother operation and successful business growth in Vermont.

Annual Reports and Compliance Requirements

In Vermont, Limited Liability Companies (LLCs) are subject to specific annual reporting requirements that are essential for maintaining good standing and ensuring compliance with state regulations. Every year, Vermont LLCs are required to file an annual report with the Secretary of State. This report serves as an official record of the company’s business activities and its current contact information, ensuring that the state maintains up-to-date records for all registered LLCs.

The annual report must be submitted by the due date of April 15 each year. It is important for LLCs to adhere to this deadline to avoid administrative dissolution, which occurs when a company fails to file its report for an extended period. Filings can be completed easily through the Vermont Secretary of State’s online portal, streamlining the process for business owners. The report is required to include the name of the LLC, the principal address, and the names and addresses of the current members or managers.

In addition to the annual report, LLCs in Vermont must also pay an associated fee when submitting their filings. As of the latest updates, the fee is $35 for the report, which can be paid online. Failure to submit the report or pay the fee can result in penalties and interest, further complicating the LLC’s compliance status. Therefore, LLCs should prioritize keeping accurate records and set reminders for these critical deadlines to ensure timely filings.

Remaining compliant with these annual reporting requirements is crucial for the operational integrity of any LLC in Vermont. Being proactive in fulfilling these obligations not only helps to avoid penalties but also builds credibility with clients, partners, and financial institutions. Ultimately, a well-maintained compliance record strengthens the LLC’s reputation and foundational business processes.

Maintaining Your LLC Status

To ensure that your Limited Liability Company (LLC) remains in good standing in Vermont, it is crucial to adhere to several best practices throughout its operational lifespan. One of the primary responsibilities of an LLC owner is to file any required annual reports with the Vermont Secretary of State. In Vermont, LLCs must file an annual report by April 15 each year. This report serves to confirm the LLC’s information, such as the business address, the names of the members or managers, and other pertinent details. Failure to submit this report on time can result in penalties or even dissolution of the company, thus, timely filings are essential.

In addition to annual reporting, proper record-keeping plays a vital role in maintaining LLC status. It is advisable to maintain accurate and thorough financial records, including income, expenses, and any transactions related to the business. This not only helps in tracking the LLC’s financial performance but is also essential for tax filings and compliance with state regulations. Establishing an organized system for maintaining these records can prevent issues during audits and provide clarity in business operations.

Moreover, adhering to state regulations is crucial for the operational integrity of your LLC. This includes ensuring that you have the necessary licenses and permits relevant to your business activities. Specific industries in Vermont may require additional compliance to carry on duties legally. Staying informed about such requirements minimizes risks of non-compliance, safeguarding both personal and business assets.

Furthermore, safeguarding your LLC’s limited liability protection involves maintaining a clear separation between personal and business finances. It is beneficial to open a dedicated business bank account and refrain from commingling personal expenses with business transactions. By following these steps diligently, you can ensure that your Vermont LLC retains its good standing and operates smoothly over time.

Closing or Dissolving an LLC in Vermont

Formally dissolving an LLC in Vermont is a significant decision that requires adherence to specific procedures to ensure compliance with state regulations. The process begins with the members of the LLC agreeing to dissolve the company, often documented in a meeting or a written agreement. Once the decision is made, it is crucial to take the proper steps to formally close the business to avoid any potential legal implications or lingering obligations.

The first step in dissolving an LLC is to file a Certificate of Cancellation with the Vermont Secretary of State. This document requires essential information, including the LLC’s name, date of formation, and a statement confirming that dissolution has been voted on by the members. This step is vital, as it officially communicates to the state that the LLC is ceasing operations.

Next, it is essential to settle any pending obligations. This includes paying off any outstanding debts, liquidating assets, and ensuring that all tax duties are fulfilled. Vermont requires businesses to file a final tax return, which should indicate that it is the final return. Failing to settle these obligations may lead to further complications, such as tax liabilities or legal actions against the LLC or its members.

Members should also consider notifying clients, vendors, and any other stakeholders about the dissolution. Transparency in this process can help prevent misunderstandings and maintain professional credibility. Additionally, it is advisable to cancel licenses and permits associated with the LLC to avoid future liabilities.

Finally, it is prudent to keep thorough records of the dissolution process. This documentation can serve as a reference in case any issues arise post-dissolution. Engaging with a legal or financial professional during this process can help navigate the complexities, ensuring that all necessary steps are completed correctly and efficiently.

Hiring Professionals for LLC Formation

Establishing an LLC in Vermont involves various legal steps that can be daunting for many entrepreneurs. One effective way to navigate this process is by hiring professionals such as business attorneys or LLC formation services. These experts bring a wealth of knowledge and experience, ensuring that the formation process is both efficient and compliant with state regulations.

One of the primary benefits of hiring a business attorney is their ability to provide personalized legal advice tailored to your specific business needs. They can assist in preparing and filing the Articles of Organization, drafting an operating agreement, and addressing any unique legal considerations related to your industry. In addition, attorneys can guide you through ongoing compliance requirements, helping you avoid potential pitfalls that could arise from misunderstandings or misinterpretations of the law.

LLC formation services are another viable option, often providing a more cost-effective approach than hiring an attorney. These services typically offer package deals that include the essential paperwork filing, registered agent services, and even additional features such as EIN (Employer Identification Number) procurement. Many businesses find that these formation services simplify the process, allowing entrepreneurs to focus on other critical aspects of starting their business.

However, it’s crucial to consider the potential costs involved in hiring professionals for LLC formation. Business attorneys may charge an hourly rate or a flat fee, which can vary significantly based on the complexity of your needs and their level of expertise. Formation services tend to have more transparent pricing structures, but it’s wise to thoroughly evaluate what is included in the package to avoid any unexpected fees.

In conclusion, while forming an LLC in Vermont can be accomplished independently, seeking the assistance of professionals can provide invaluable benefits. Whether opting for a business attorney or a formation service, weighing the costs and advantages will help ensure a smooth and compliant start for your business.

Common Mistakes to Avoid

Establishing a Limited Liability Company (LLC) in Vermont is a significant step for entrepreneurs aiming to protect their personal assets while enjoying greater operational flexibility. However, many newcomers make common mistakes that could jeopardize this process. Recognizing and avoiding these pitfalls can facilitate a smoother formation and improve the overall management of the LLC.

One frequent misstep is not conducting thorough research on the name of the LLC. Prior to filing, it is crucial to ensure that the chosen name is unique and compliant with Vermont’s naming requirements. Failing to confirm that the business name is not already in use can lead to delays or the rejection of the LLC application.

Another common error is overlooking the importance of drafting an operating agreement. While Vermont does not legally require an operating agreement for LLCs, having one can significantly impact how the business operates. This document details the structure of the LLC, outlines the responsibilities of each member, and establishes protocols for resolving disputes. Not having a clear agreement may lead to confusion and conflicts among members in the future.

Entrepreneurs also tend to underestimate the significance of compliance with state regulations. Not being aware of local, state, and federal licensing requirements can hinder business operations and lead to fines or even forced closure. It is essential for business owners to familiarize themselves with the applicable laws governing their specific industry within Vermont.

Lastly, some may neglect to maintain accurate financial records. Regardless of business size, proper bookkeeping is crucial for maintaining the LLC’s legal standing and ensuring its fiscal health. Implementing effective accounting practices from the beginning can prevent future complications related to taxation and financial audits.

In essence, avoiding these common mistakes can not only streamline the LLC formation process in Vermont but also contribute significantly to the business’s long-term success. By being diligent and proactive, entrepreneurs can create a solid foundation for their LLC, allowing for growth and sustainability in their chosen industry.

Resources for Vermont LLC Owners

Establishing and managing a Limited Liability Company (LLC) in Vermont requires access to various resources that can assist owners throughout their business journey. A solid foundation of information and support is crucial for LLC owners to navigate the complexities of business regulations, funding, and networking. Below is an overview of valuable resources tailored for Vermont LLC owners.

Firstly, the Vermont Secretary of State’s website is an essential resource. It provides crucial information on business formation, required filings, and compliance with state laws. This resource features guidelines for licensing and permits, making it easier for entrepreneurs to understand their obligations. Additionally, the website offers access to forms necessary for maintaining an LLC, such as annual reports and registration updates.

Another important organization is the Vermont Small Business Administration (SBA). The SBA offers financial assistance, mentoring, and training programs designed to empower local businesses. Their resources include comprehensive guides on funding options, grant opportunities, and strategies for business growth.

Local business associations, such as the Vermont Chamber of Commerce, create networking opportunities for LLC owners. The Chamber advocates for local businesses and hosts events that encourage collaboration among entrepreneurs, promoting relationships that can lead to potential partnerships, customers, and resource sharing.

Furthermore, nonprofit organizations like SCORE offer mentoring and workshops specifically for small businesses. SCORE’s experienced volunteer mentors provide personalized guidance on various topics, including business planning, marketing strategies, and operational efficiency. This free service greatly benefits LLC owners seeking expert advice without additional costs.

Finally, leveraging social media platforms and local business networks can help Vermont LLC owners connect with peers, share experiences, and access a wealth of real-time information. By utilizing these resources, entrepreneurs can enhance their business acumen, ensuring they remain compliant while fostering growth in the vibrant Vermont business community.

Networking and Support for Vermont Businesses

Networking and support systems are pivotal for the success of business owners in Vermont. Engaging with local networks not only fosters relationships but also enhances opportunities for collaboration, sharing of ideas, and resources essential for business growth. Vermont offers a rich tapestry of commerce, with several local chambers of commerce and business groups that serve as platforms for professionals to connect and thrive. These organizations are geared towards advocating for the interests of their members while providing a host of valuable resources.

Membership in local chambers of commerce can be particularly beneficial for entrepreneurs. These organizations typically offer networking events, educational workshops, and seminars aimed at equipping members with essential skills and knowledge needed in today’s marketplace. Such engagements not only facilitate introductions to potential clients or partners but also help business owners remain informed about legislation, economic trends, and community needs that impact their operations. Moreover, they provide a sense of belonging within the local business ecosystem, which is crucial, especially for new business owners in Vermont who may feel isolated when starting out.

Additionally, various business groups focus on specific industries or demographics, allowing for a more tailored support system. For instance, groups focusing on women entrepreneurs or minority-owned businesses can provide targeted networking opportunities. These specialized networks help in sharing best practices and fostering mentorship among peers, opening doors to partnerships that might not be available in broader networks.

Ultimately, the significance of networking and support in Vermont cannot be understated. Effective engagement with local chambers and business groups equips owners not only with invaluable contacts but also with the collective knowledge to overcome common challenges faced in entrepreneurship. Leveraging these support systems enhances the potential for sustained growth and community integration, essential elements for any successful business in Vermont.

Success Stories: Vermont LLCs

Vermont has emerged as a favorable destination for entrepreneurs seeking to establish limited liability companies (LLCs) due to its supportive business environment and attractive economic landscape. Several successful Vermont LLCs exemplify the potential benefits and growth opportunities accessible to business owners in the state. One notable example is Ben & Jerry’s, the iconic ice cream brand founded in 1978. Originally a small startup, it has grown into a global force, focusing on quality ingredients, social responsibility, and unique flavors. Ben & Jerry’s reflects how an LLC structure can provide limited liability while enabling businesses to thrive.

Another example is SmartWater, a hydration company that offers premium bottled water sourced from the pristine waters of Vermont. This LLC has gained recognition for its commitment to sustainability and environmental stewardship, drawing customers invested in eco-friendly practices. SmartWater showcases how Vermont’s LLC framework facilitates not only financial protection for owners but also encourages businesses to pursue innovative and socially responsible practices.

Additionally, the Vermont Bread Company stands out as a successful venture that began with a passion for artisanal baking. This LLC has achieved growth by focusing on local sourcing and creating high-quality products that resonate with consumers. The Vermont Bread Company highlights the ability of LLCs to adapt and evolve while maintaining a strong connection to their community and values.

These success stories underline the potential of Vermont LLCs to foster entrepreneurship, promote responsible business practices, and contribute to the local economy. The examples of Ben & Jerry’s, SmartWater, and Vermont Bread Company demonstrate how the LLC structure can facilitate growth while offering protection and flexibility, ultimately leading to sustainable success in the competitive business landscape.

Conclusion: Your Next Steps

Establishing a Limited Liability Company (LLC) in Vermont can be a beneficial decision for any entrepreneur looking to protect their personal assets while expanding their business opportunities. This comprehensive guide has outlined the essential steps that are critical for successful Vermont LLC formation, ensuring that you are well-equipped to navigate through the process.

The first step involves choosing a unique name for your LLC that complies with Vermont’s naming requirements. Once that is established, it is crucial to appoint a registered agent who will act as the point of contact for your business. The next stage is filing the Articles of Organization with the Vermont Secretary of State, which officially initiates your LLC’s formation. Thereafter, drafting an Operating Agreement is recommended, as it provides a framework for the LLC’s management and operations.

After completing these fundamental steps, it is advisable to obtain any necessary business licenses or permits specific to your industry. Additionally, applying for an Employer Identification Number (EIN) from the IRS is essential for tax purposes and may be mandatory if you plan to hire employees or operate as a partnership. Regular compliance with Vermont’s annual report and tax obligations will ensure your LLC remains in good standing.

As you embark on this exciting journey of forming your LLC in Vermont, remain conscious of the various resources available to assist you. There are numerous online services, legal professionals, and local business organizations that can simplify the process and provide guidance. Remember, the most successful entrepreneurs are those who take decisive action and remain adaptable. Your dreams are within reach; take that first step today toward establishing your LLC and reaping the benefits that come with it.

Frequently Asked Questions

When considering the formation of a Limited Liability Company (LLC) in Vermont, many individuals encounter a series of common questions and concerns. This section addresses those inquiries, providing clarity on the essential aspects of Vermont LLC formation.

One common question is, “What is the primary benefit of forming an LLC in Vermont?” The most significant advantage lies in the protection it offers to personal assets. By establishing an LLC, owners (also known as members) can limit their liability, ensuring that personal property is safeguarded against business debts and legal judgments. Additionally, LLCs benefit from pass-through taxation, meaning profits are taxed at the individual level rather than at the corporate level, which can be an appealing choice for many business owners.

Another frequent concern pertains to the costs associated with forming and maintaining an LLC in Vermont. The startup costs are relatively low, particularly when compared to corporations. In Vermont, the filing fee for Articles of Organization is currently $125. Moreover, yearly paperwork, including the annual report, incurs a nominal fee of $35, making it an economically viable option for many entrepreneurs.

Individuals often wonder about the necessary steps to form an LLC in Vermont. The process typically begins with selecting a unique name that complies with Vermont’s naming guidelines. Following this, entrepreneurs must file the Articles of Organization with the Vermont Secretary of State. They may also consider creating an operating agreement to outline the management structure and operational procedures of the LLC, although this is not mandatory.

For those seeking further assistance, resources such as the Vermont Secretary of State’s website and local business development centers are invaluable. These platforms can offer additional guidance and support as individuals navigate the nuances of LLC formation in Vermont.

Additional Reading and References

For those who wish to delve deeper into the process of LLC formation in Vermont and related business topics, a range of valuable resources is available. These references can provide insights into various aspects of managing and forming a Limited Liability Company (LLC), ensuring you have a well-rounded understanding. Here are some recommended readings:

1. Vermont Secretary of State – LLC Information: This official site from the Vermont Secretary of State offers comprehensive details on the steps required to establish an LLC in Vermont. It outlines necessary filings, fees, and ongoing compliance obligations.

2. Nolo – Formation of an LLC in Vermont: Nolo provides a user-friendly overview of the LLC formation process, including beneficial tips and potential pitfalls. The articles written by legal experts offer practical advice tailored to Vermont laws.

3. Inc. – How to Form an LLC in Vermont: This guide from Inc. is beneficial for entrepreneurs seeking a clear and concise outline of creating an LLC. It not only discusses formation but also explores the advantages of this structure for business owners.

4. Benchmark Business – Understanding Vermont LLCs: This article contains a more nuanced discussion about the operational aspects of LLCs in Vermont. It highlights tactical considerations and the importance of maintaining personal liability protection.

5. U.S. Small Business Administration – Choose a Business Structure: Although not Vermont-specific, this resource is invaluable for understanding the various types of business structures available, helping entrepreneurs make informed decisions about forming their LLCs.

These resources will serve as a solid foundation for anyone considering setting up an LLC in Vermont, supplemented by expert advice and regulatory information critical for successful business management.