Introduction to LLCs in Wyoming

A Limited Liability Company (LLC) is a flexible business structure that combines the advantages of a corporation with those of a partnership. This formation type protects its owners, known as members, from personal liability for the company’s debts and obligations. In essence, an LLC offers personal asset protection, wherein members are generally not personally liable for business liabilities, thus safeguarding their individual properties and finances from business-related risks.

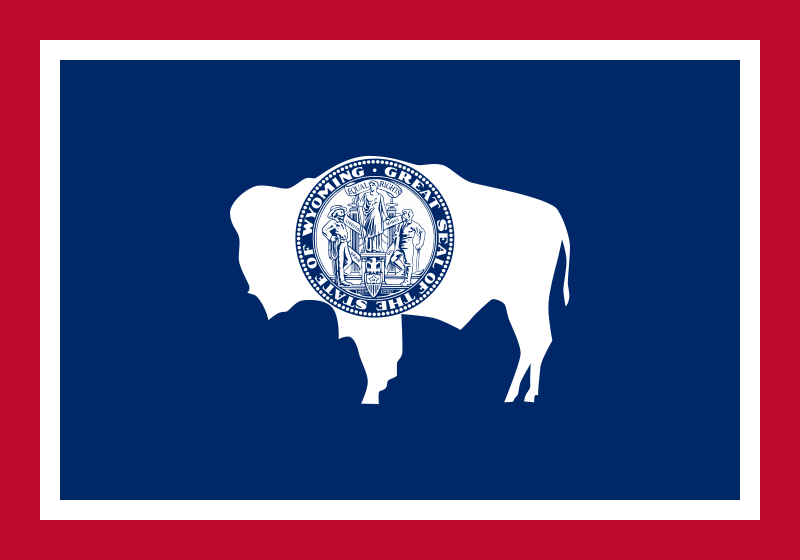

Wyoming has emerged as a leading state for LLC formation due to several distinctive benefits. Firstly, it boasts a favorable legal environment with strong privacy protections. The state does not require LLC members to be publicly disclosed, allowing individuals to maintain a level of anonymity in their business dealings. This feature is particularly appealing for entrepreneurs seeking to protect their identities and minimize exposure to unsolicited solicitations.

Another significant advantage of forming an LLC in Wyoming is the lack of state income taxes on LLC earnings. This tax structure allows businesses to retain a larger portion of their profits, providing a financial edge for those operating in the state. Furthermore, Wyoming’s annual fees and franchise taxes are relatively low compared to other states, making it a cost-effective option for business owners. The streamlined regulatory framework and efficient filing processes also add to the appeal of creating an LLC in Wyoming.

Additionally, Wyoming’s business-friendly climate fosters a strong entrepreneurial ecosystem, which is ideal for startups and small businesses. The state provides resources, support, and incentives for new ventures, ensuring that entrepreneurs have access to the tools they need to succeed. As a result, Wyoming is not just a popular choice for new businesses but has also become a preferred state for many established companies looking to optimize their operations through an LLC structure.

Benefits of Forming an LLC in Wyoming

Establishing a Limited Liability Company (LLC) in Wyoming offers numerous advantages that can significantly benefit businesses and entrepreneurs. One of the primary benefits is the remarkable tax advantages associated with Wyoming LLC formation. The state does not levy a corporate income tax or a personal income tax. This favorable tax treatment allows companies to retain more of their earnings, making it an attractive option for business owners seeking to minimize their tax liabilities.

In addition to tax benefits, Wyoming is renowned for its stringent privacy regulations. When forming an LLC, the state does not require the disclosure of members’ names in the public record; instead, only the name of the registered agent is required. This anonymity provides an added layer of privacy and security, appealing to entrepreneurs who value confidentiality in their business dealings. The ability to operate without public exposure is a significant draw for many individuals establishing a new business.

Furthermore, ease of compliance plays a crucial role in the allure of Wyoming as a business haven. The state boasts a straightforward registration process, allowing entrepreneurs to focus on building their businesses rather than navigating complex regulations. Wyoming also offers flexible management structures, enabling LLCs to adopt operational frameworks that best suit their needs. The minimal regulatory oversight makes it easier for owners to maintain compliance with state requirements.

In light of these benefits, Wyoming stands out as a desirable location for forming an LLC. The combination of favorable tax treatment, privacy protections, and simple compliance processes not only enhances the overall business environment but positions Wyoming as a premier choice for entrepreneurs seeking to establish their operations and thrive within a supportive framework.

Understanding the Articles of Organization

The Articles of Organization are a crucial document in the formation of a Limited Liability Company (LLC) in Wyoming. This foundational document serves as the official statement that establishes the legal existence of the LLC under the laws of the state. By filing the Articles of Organization with the Wyoming Secretary of State, the business is recognized as a distinct legal entity, separating personal liability from business obligations. This document is key to gaining the benefits of limited liability protection, which is one of the primary motivations for forming an LLC.

When creating the Articles of Organization, certain essential information must be included to ensure compliance with state regulations. Typically, these details consist of the LLC’s name, which must be unique and include the term “Limited Liability Company” or its abbreviations, such as “LLC.” Additionally, the Articles must provide the physical address of the LLC’s principal office, which cannot be a P.O. Box. The name and address of the registered agent, who is responsible for receiving legal documents on behalf of the LLC, must also be included. The registered agent can be an individual resident or a business authorized to conduct business in Wyoming.

Moreover, it is important to stipulate whether the LLC will be managed by its members or by designated managers. This distinction affects the governance structure of the company. While not mandatory, it is beneficial to outline the duration of the LLC, whether it is intended to be perpetual or for a specific term. By accurately completing the Articles of Organization and filing them promptly, individuals can ensure their LLC is established smoothly, paving the way for future business operations and statutory compliance in Wyoming.

Step-by-Step Guide to Forming a Wyoming LLC

Forming a Limited Liability Company (LLC) in Wyoming provides numerous advantages, including asset protection and tax flexibility. The process requires careful consideration and adherence to legal requirements. Below is a step-by-step guide to assist individuals in successfully establishing a Wyoming LLC.

The first step in the formation process is to choose a unique name for the LLC. The name must comply with Wyoming state regulations, which dictate that it should include “Limited Liability Company” or its abbreviations, such as “LLC.” To ensure availability, it is advisable to conduct a name search through the Wyoming Secretary of State’s website.

Next, the formation of the LLC necessitates the appointment of a registered agent. A registered agent is an individual or entity authorized to receive legal documents on behalf of the LLC. In Wyoming, the registered agent must have a physical address within the state. This step is critical because it ensures legal compliance and effective communication for the LLC.

After establishing the name and appointing a registered agent, the next step is to prepare and file the Articles of Organization with the Wyoming Secretary of State. This document serves as the official formation document for the LLC and typically requires details such as the LLC name, the registered agent’s information, and the business address. Filing can be completed online or via mail, with the associated filing fee.

Upon approval of the Articles of Organization, the LLC must draft an Operating Agreement. Although not a requirement in Wyoming, this document outlines the management structure and operational procedures of the LLC. Creating an Operating Agreement is a prudent action as it can help prevent disputes among members and clarify each member’s responsibilities.

The final steps of forming a Wyoming LLC include acquiring any necessary licenses or permits to legally operate the business and obtaining an Employer Identification Number (EIN) from the IRS for tax purposes. Following these comprehensive steps will ensure the successful establishment of a Wyoming LLC.

Choosing a Name for Your LLC

When forming a Limited Liability Company (LLC) in Wyoming, selecting an appropriate name is a vital step in the business registration process. The name of your LLC must comply with specific regulations set forth by the Wyoming Secretary of State. One of the primary requirements is that the name must distinguish your LLC from other registered entities in the state. This prevents confusion among consumers and helps protect your brand identity.

To start, ensure that the name you wish to use includes the term “Limited Liability Company” or its abbreviations, such as “LLC” or “L.L.C.” This is essential for clarity regarding the legal structure of your business. Additionally, your chosen name cannot include terms that suggest a different type of business entity, such as “corporation” or “bank,” without proper approval.

Before finalizing your LLC name, it is prudent to check its availability through the Wyoming Secretary of State’s database. This online resource enables potential business owners to search for existing LLC names and ascertain whether their desired name is already in use. Conducting this search helps avoid potential conflicts and ensures that your business name is unique within Wyoming.

Once you have verified that the name is available, consider performing a trademark search to ensure that the name is not protected at the federal level. This additional step may prevent legal issues in the future, particularly if you plan to expand your business beyond Wyoming or engage in interstate commerce.

In conclusion, choosing a name for your Wyoming LLC requires careful consideration and compliance with state regulations. By ensuring uniqueness, verifying availability, and adhering to the naming guidelines set by the Secretary of State, you will establish a solid foundation for your new business venture.

Filing Your Articles of Organization Online

Filing your Articles of Organization online is a straightforward process that can be completed through the Wyoming Secretary of State’s website. This method is advantageous as it allows for a relatively quick submission and immediate confirmation of filing, streamlining the entire LLC formation process.

To begin, you will need to navigate to the Wyoming Secretary of State’s business services section on their official website. Here, you will find the option to file Articles of Organization. Before initiating your submission, it is essential to gather all required information to ensure a smooth filing experience. Typically, the necessary details include the name of your LLC, which must comply with Wyoming naming regulations, the address of the principal office, and the registered agent’s name and address. The registered agent is required to be a resident individual or a qualified business entity, authorized to conduct business in Wyoming.

Once you have assembled all the necessary information, click on the designated link to start the online filing process. The website will prompt you to fill in a form with the gathered details. After completing the form, it is critical to review the information for accuracy before proceeding to the payment section. The filing fee is usually around $100, but it may vary, so ensure to check the current fee on the website.

After submitting your online application and completing the payment, you will receive an email confirmation. The processing time for your Articles of Organization is typically expedited, often taking only a few business days. This efficiency is one of the benefits of filing your Articles of Organization online. Make sure to save the confirmation for your records, as it serves as proof of your LLC’s formation in Wyoming.

State Fees for Forming an LLC

Establishing a Limited Liability Company (LLC) in Wyoming involves certain state fees, crucial for prospective business owners to understand. The primary fee incurred during the formation process is the fee for filing the Articles of Organization. As of October 2023, the standard filing fee for this document is $100. This fee is applicable regardless of the structure of the LLC, whether it is a single-member or multi-member entity. The Articles of Organization serve as the foundational document that officially registers the LLC with the state, thus incurring this initial cost.

In addition to the Articles of Organization, applicants may encounter other potential expenses that are essential to consider when planning the formation of an LLC. One such fee is the reservation of a company name, which costs $50 and allows for a name to be held for up to 120 days before filing the Articles of Organization. Though optional, this can be beneficial for those who wish to secure a preferred company name before officially forming their LLC.

Moreover, ongoing costs should also be taken into account. Wyoming mandates an annual report, which incurs a fee of $50 or a fee based on the company’s assets located within the state, whichever is higher. This requirement emphasizes the importance of budgeting for both initial and recurring expenses when forming an LLC. It is prudent to conduct thorough research or consult with legal experts regarding additional costs that might arise, such as obtaining necessary licenses or permits depending on the nature of the business.

Overall, while the formation fees for an LLC in Wyoming are relatively straightforward, the total startup costs can vary based on individual circumstances and additional business needs.

Registered Agent Requirements in Wyoming

In Wyoming, every LLC is legally required to designate a registered agent, who acts as the main point of contact between the LLC and the state. The registered agent is responsible for receiving important legal documents such as service of process, tax notices, and other official correspondence. This role is crucial, as it ensures that the LLC remains compliant with state regulations and is adequately informed about any legal matters requiring attention.

When choosing a registered agent in Wyoming, it is essential to consider several factors. The representative can be an individual or a business entity, but they must have a physical address in Wyoming and be available during regular business hours. This stipulation differentiates a registered agent from a mere mailing address, as the agent must be capable of receiving legal documents in person.

Potential candidates for registered agents may include members of the LLC, individual residents of the state, or professional registered agent services that specialize in offering this function. While selecting a registered agent, it is advisable to ensure they possess a reliable reputation and adequate experience. This helps guarantee that they will perform their responsibilities effectively and manage any incoming documentation promptly.

Moreover, a registered agent must be at least 18 years old and have the legal authority to conduct business in Wyoming. It is also important for the registered agent to maintain confidentiality, especially regarding sensitive legal matters. By fulfilling these requirements and adhering to state regulations, the registered agent significantly contributes to the LLC’s compliance and overall operational stability.

Creating an Operating Agreement

Establishing an operating agreement is a crucial step in the formation of a Limited Liability Company (LLC) in Wyoming. This document serves as an internal governing blueprint for the LLC, outlining the rights, responsibilities, and procedures for all members. Although the state does not legally require an operating agreement, having one is strongly recommended as it provides clarity and stability to the management structure and operations of the business.

An effective operating agreement should cover several essential components. First and foremost, it should define the ownership interests of each member, delineating how profits and losses will be allocated among them. Additionally, the agreement should include the decision-making process for the LLC, specifying how members will vote on important issues. This includes identifying whether decisions require a simple majority or a higher threshold for approval, ensuring that all members are informed and involved in governance.

Moreover, the operating agreement must detail the responsibilities and roles of each member, which helps prevent misunderstandings and conflicts in the future. This section should clarify who manages the day-to-day operations, who can bind the company in contracts, and what the procedure is for transferring ownership interests. Furthermore, including provisions for resolving disputes can safeguard the company against potential conflicts by providing a clear process for mediation or arbitration.

Ultimately, the operating agreement serves as a vital document not only for internal governance but also for protecting the limited liability status of the members. If disputes arise, having a well-drafted operating agreement can help demonstrate the intent to operate as an LLC, thereby reinforcing its legitimacy. Without this document, members may risk personal liability for business debts or legal issues, undermining the key benefits of forming an LLC in Wyoming.

EIN Application Process

Obtaining an Employer Identification Number (EIN) from the Internal Revenue Service (IRS) is a crucial step for any business entity, including Wyoming Limited Liability Companies (LLCs). An EIN functions as a unique identifier for your LLC, similar to a Social Security number for individuals. This number is essential for various business activities, including tax filings, opening a business bank account, and hiring employees. In general, any LLC that plans to hire employees or operate as a corporation should apply for an EIN.

The process of obtaining an EIN is relatively straightforward. As a first step, you can visit the IRS website, where the online EIN application is available. The online application is convenient, allowing you to complete the process in a single session. However, if an online application is not feasible, you may also apply by submitting Form SS-4 via mail or fax. Regardless of the method chosen, it is crucial to complete all sections of the application accurately to avoid unnecessary delays.

When completing the application, you will need to provide key information about your LLC, including its name, address, and the nature of the business. You’ll also need to specify the reason for applying for an EIN. The IRS typically processes online applications promptly, issuing the EIN during the session. For mail or fax applications, it may take several weeks to receive your EIN, so it’s advisable to plan accordingly.

Having an EIN offers numerous benefits for your LLC. It enables you to separate your personal and business finances, protecting your personal assets. Moreover, possessing an EIN simplifies tax obligations and facilitates hiring employees, as it is often required for payroll purposes. Overall, applying for an EIN is an essential step in establishing and operating a compliant and successful Wyoming LLC.

Opening a Business Bank Account

Forming a Limited Liability Company (LLC) in Wyoming is an essential step towards establishing a legal business presence. One of the subsequent crucial actions to take after LLC formation is opening a dedicated business bank account. This step not only provides a professional appearance but also plays a significant role in maintaining the legal protection afforded by the LLC structure.

To open a business bank account, you will typically need several key documents. Firstly, the Articles of Organization, which serve as proof that your LLC is officially registered in Wyoming, must be provided. Additionally, a Federal Employer Identification Number (EIN), obtained from the IRS, is required for tax purposes and helps to differentiate your business from personal finances. Banks often request an Operating Agreement as well, which outlines the management structure and operational guidelines of your LLC, even if it is not legally required in Wyoming.

Furthermore, valid identification such as a driver’s license or passport is necessary for all individuals authorized to access the business bank accounts. It is advisable to check with your chosen financial institution regarding any other specific requirements, as these can vary by bank.

One of the significant advantages of having a separate business bank account is the clarity it provides in financial management. By keeping personal and business finances apart, owners can simplify bookkeeping, provide transparent records for tax reporting, and protect personal assets in litigation scenarios. Moreover, a dedicated business account can enhance credibility with clients and suppliers, thereby contributing to the overall professionalism of the LLC. This separation of finances is not merely a recommendation; it is essential for maintaining the integrity of your business’s legal status and financial health.

Required Licenses and Permits in Wyoming

When forming a Limited Liability Company (LLC) in Wyoming, it is crucial to understand the various licenses and permits that may be required to legally operate the business. The specific licenses needed can vary based on the industry and type of business activity. Therefore, conducting thorough research to identify the necessary licenses is an important step in the LLC formation process.

Wyoming does not have a general business license requirement at the state level, yet many local jurisdictions may impose their own licensing requirements. A business owner should begin by checking with the county or city where the LLC will be operating, as local business licenses, permits, or zoning approvals might be mandatory. This is particularly pertinent for businesses that engage in specific regulated activities, such as healthcare, food service, or construction.

In addition to local prerequisites, industry-specific licenses and permits must also be considered. For instance, professionals such as accountants, architects, or contractors may need to acquire licensing from the relevant state boards. These licenses ensure that businesses comply with industry standards and regulations, which helps protect consumers and maintain professional integrity.

To determine the exact licenses required, entrepreneurs can utilize resources provided by the Wyoming Secretary of State’s office. Their website includes guidance on the various business regulations and requirements based on different business types. Furthermore, consulting a legal professional or a business advisor can help in ensuring compliance and navigating the complexities associated with licenses and permits.

In conclusion, while forming an LLC in Wyoming, it is essential to identify and obtain the necessary licenses and permits that apply to the specific business operations. By understanding both the local and state-level requirements, LLC owners can establish their businesses lawfully and efficiently.

Annual Reporting Requirements for Wyoming LLCs

In Wyoming, each Limited Liability Company (LLC) is required to submit an annual report, which serves as a critical compliance obligation. This report must be filed with the Wyoming Secretary of State to ensure that the company maintains its good standing status. The annual reporting requirement promotes transparency and keeps the state’s business registry updated with current information about the LLC.

The filing deadline for the annual report is the first day of the month in which the LLC was formed. For example, if an LLC was established on March 15, its annual report must be submitted by March 1 of each subsequent year. Timely filing is crucial, as failure to submit the report can lead to penalties, including a late fee and the potential administrative dissolution of the LLC. LLC owners should mark this deadline on their calendars to avoid any lapses in compliance.

In terms of fees, Wyoming LLCs are required to pay an annual report fee, which is determined based on the company’s assets located within the state. The minimum fee is $50, but this amount can increase if the LLC holds more significant assets in Wyoming. It is important for business owners to calculate this accurately to ensure prompt payment and compliance with state regulations.

Maintaining compliance with annual reporting requirements is not just a legal obligation but also vital for the LLC’s operational credibility. Keeping the business in good standing, through timely filing of reports and fees, enhances the LLC’s reputation with clients, partners, and regulatory bodies. By adhering to these requirements, Wyoming LLC owners ensure their businesses remain fully operational and legally recognized within the state.

Tax Obligations for LLCs in Wyoming

Establishing a Limited Liability Company (LLC) in Wyoming offers numerous advantages, particularly regarding tax obligations. LLCs in Wyoming must adhere to both state and federal tax requirements, although the state provides a favorable tax environment. Notably, Wyoming does not impose a corporate income tax, making it an attractive option for LLCs seeking minimal state taxation.

At the state level, Wyoming LLCs are subjected to a modest annual fee and a franchise tax, which is relatively low compared to other states. The annual fee is based on the value of the company’s assets or the number of members in the LLC, ensuring that tax obligations remain manageable. Additionally, LLCs may need to collect and remit sales taxes if they engage in retail activities or have nexus within the state, thereby contributing to the overall tax obligations that may arise from their business operations.

On the federal level, LLCs are considered pass-through entities for tax purposes unless they elect to be taxed as a corporation. As pass-through entities, the profits and losses of an LLC pass directly to its members, who report them on their personal tax returns. This structure helps avoid the double taxation typically associated with traditional corporations, benefiting LLC members financially. However, it is essential for LLCs to remain compliant with federal tax filings, including income tax returns and any applicable employment taxes if they have employees.

Overall, while Wyoming LLCs enjoy a favorable tax climate with minimal state taxation, it is crucial for owners to understand their obligations at both the state and federal levels. Properly managing these tax responsibilities is vital to maintaining compliance and ensuring the ongoing success of the LLC.

Dissolution of an LLC in Wyoming

Dissolving an LLC in Wyoming is a structured process that requires adherence to specific regulatory requirements. The primary objective is to formally terminate the business entity and ensure that all obligations are resolved. This process typically begins with a thorough review of the LLC’s operating agreement, which may outline the necessary procedures for dissolution.

The first step in dissolving a Wyoming LLC involves obtaining consensus among the members. If the operating agreement provides a defined procedure for dissolution, it must be followed. In the absence of such provisions, the Wyoming Limited Liability Company Act stipulates that dissolution requires a vote from the members, where a majority typically suffices unless the operating agreement states otherwise.

Once the decision to dissolve the LLC is made, the next phase is to settle any outstanding debts and liabilities. It is essential to ensure that the LLC fulfills its financial obligations before proceeding further. This may include settling contracts, paying outstanding taxes, and addressing creditors’ claims. Any remaining assets should be distributed among the members according to the ownership percentages defined in the operating agreement.

Following the resolution of debts, the LLC must officially file Articles of Dissolution with the Wyoming Secretary of State. This document formalizes the decision to dissolve the entity and includes pertinent information such as the LLC’s name, filing number, and the effective date of dissolution. A filing fee is also required at this stage. Once the Articles of Dissolution are accepted, the LLC is officially dissolved.

Finally, it is prudent for members to retain copies of all dissolution documentation and financial records for their files. This documentation may be necessary for future legal or tax purposes. Adhering to the above steps ensures a smooth and compliant dissolution of the LLC in Wyoming.

Common Mistakes to Avoid When Forming an LLC

Forming a Limited Liability Company (LLC) is a significant step for entrepreneurs looking to protect their personal assets while enjoying the benefits of a flexible business structure. However, there are common mistakes that can complicate the LLC formation process and potentially jeopardize the advantages of this business model. Recognizing and avoiding these pitfalls is crucial to ensuring a smooth and successful formation.

One of the most frequent errors is failing to choose the appropriate name for the LLC. The chosen name must comply with state regulations, which often prohibit the use of certain terms or require specific identifiers such as “LLC” or “Limited Liability Company.” It’s essential for entrepreneurs to conduct thorough name availability searches to avoid using a name that is already registered by another business, which could lead to legal disputes.

Another common mistake is neglecting to create an operating agreement. While not always mandatory, an operating agreement is vital as it outlines the rights, responsibilities, and management structures of the LLC. This document can prevent misunderstandings among members and provide a clear framework for decision-making. Additionally, failing to separate personal and business finances is a significant error. Entrepreneurs should maintain distinct bank accounts for the LLC and avoid mixing personal transactions with business affairs to protect the limited liability status.

Furthermore, many entrepreneurs overlook the importance of compliance with state-specific regulations. Each state has its own set of requirements, forms, and fees for LLC formation. Ignoring these rules may result in unnecessary delays or penalties. Hiring a professional, such as an attorney or accountant, can help navigate these complexities and ensure all necessary documentation is submitted correctly and in a timely manner.

Lastly, failing to obtain the necessary permits and licenses can pose challenges post-formation. Depending on the nature of the business, various local, state, or federal permits may be required. Conducting thorough research and obtaining the needed licenses will facilitate a smoother operational start following the LLC formation.

Resources for Wyoming LLC Business Owners

Establishing a Limited Liability Company (LLC) in Wyoming comes with numerous resources that can aid business owners in navigating regulations, legal requirements, and operational guidelines. These resources are essential for ensuring that entrepreneurs are compliant with state laws and can effectively manage their businesses.

One of the primary resources is the Wyoming Secretary of State’s website, which houses crucial information regarding the formation and operation of LLCs in the state. This site provides guidelines on how to register an LLC, important forms that need to be filed, and the ongoing compliance requirements, including annual reports and fees. The website also features an online portal for business registration, making it easier for owners to manage their submissions digitally.

In addition to state resources, various business forums and networks specifically cater to Wyoming LLC owners. Websites such as Wyoming Business Alliance offer networking opportunities, mentorship, and support from fellow entrepreneurs. Additionally, forums such as Alignable and Reddit’s Wyoming community provide platforms for discussions, advice-sharing, and troubleshooting common issues faced by LLC owners.

Moreover, there are various supplementary reading materials available. Books like “Wyoming LLC: A Complete Guide to Starting Your LLC in Wyoming” and articles found on comprehensive business blogs elaborate on the nuances of running an LLC in Wyoming. These resources provide detailed insights into best practices, tax implications, and effective business strategies specifically tailored to the unique regulatory environment of Wyoming.

Collectively, these resources serve as an invaluable toolkit for Wyoming LLC owners, guiding them through the complexities of business ownership and fostering a supportive entrepreneurial community.

Conclusion and Final Thoughts

In this comprehensive guide on Wyoming LLC formation, we have explored the essential steps and elements involved in establishing a limited liability company in the state of Wyoming. We began by highlighting the advantages of forming an LLC, such as limited personal liability, favorable tax structures, and operational flexibility. These benefits underscore the importance of selecting the right business entity to align with your entrepreneurial goals.

We have detailed the procedural aspects necessary for successful LLC formation. This includes choosing a unique name that complies with state requirements, appointing a registered agent, and filing Articles of Organization with the Wyoming Secretary of State. The guide also covered the importance of creating an Operating Agreement, which serves as the internal governing document for the LLC, delineating responsibilities, ownership interests, and operational procedures among members.

Moreover, tax registrations and securing any necessary permits or licenses were emphasized as crucial components that ensure your LLC operates legally and efficiently. The significance of maintaining good standing by adhering to annual reporting requirements was also discussed, as this helps avoid penalties and ensures ongoing compliance with state laws. Each of these steps plays a vital role in the successful establishment and maintenance of your LLC.

We encourage prospective business owners to meticulously follow the outlined steps in this guide, as they lay the groundwork for a robust and compliant business entity. By doing so, you can safeguard your personal assets while enjoying the benefits of running a limited liability company in Wyoming. Taking the plunge into LLC formation is an investment in your future; therefore, ensure you are well-prepared to embark on this exciting journey of entrepreneurship.

Frequently Asked Questions

When it comes to forming a Limited Liability Company (LLC) in Wyoming, many prospective business owners have a range of questions. Understanding these common inquiries can help clarify the process and ensure that entrepreneurs are well-prepared for their new venture.

One frequently asked question is about the cost associated with forming an LLC in Wyoming. The primary fees include the initial filing fee, which is typically around $100, and annual report fees which are based on the assets of the LLC. Additionally, there may be costs for legal assistance or registered agent services, which are essential for compliance. It is advisable to budget for these expenses to avoid any surprises during the formation process.

Another common concern involves the time frame for establishing an LLC in Wyoming. Generally, the process can be completed relatively quickly, often within a week, if all required documents are prepared and submitted correctly. However, factors such as state processing times and any additional requirements specific to the business type may influence this timeline. Entrepreneurs should allow sufficient time for approvals, particularly if they plan to begin operations by a specific date.

Prospective owners often seek clarity on the legal protections an LLC provides. A significant advantage of forming an LLC is that it creates a separation between personal and business assets, thus safeguarding personal property from business liabilities. This liability protection is crucial for minimizing risk, especially for new business owners who may face unpredictability in the early stages of their operations.

Lastly, many individuals inquire about compliance requirements post-formation. Maintaining an LLC in Wyoming entails filing an annual report and paying any applicable fees. Furthermore, it is recommended to keep detailed records and maintain compliance with both state and federal regulations to ensure smooth operations.