Introduction to Emergency Funds

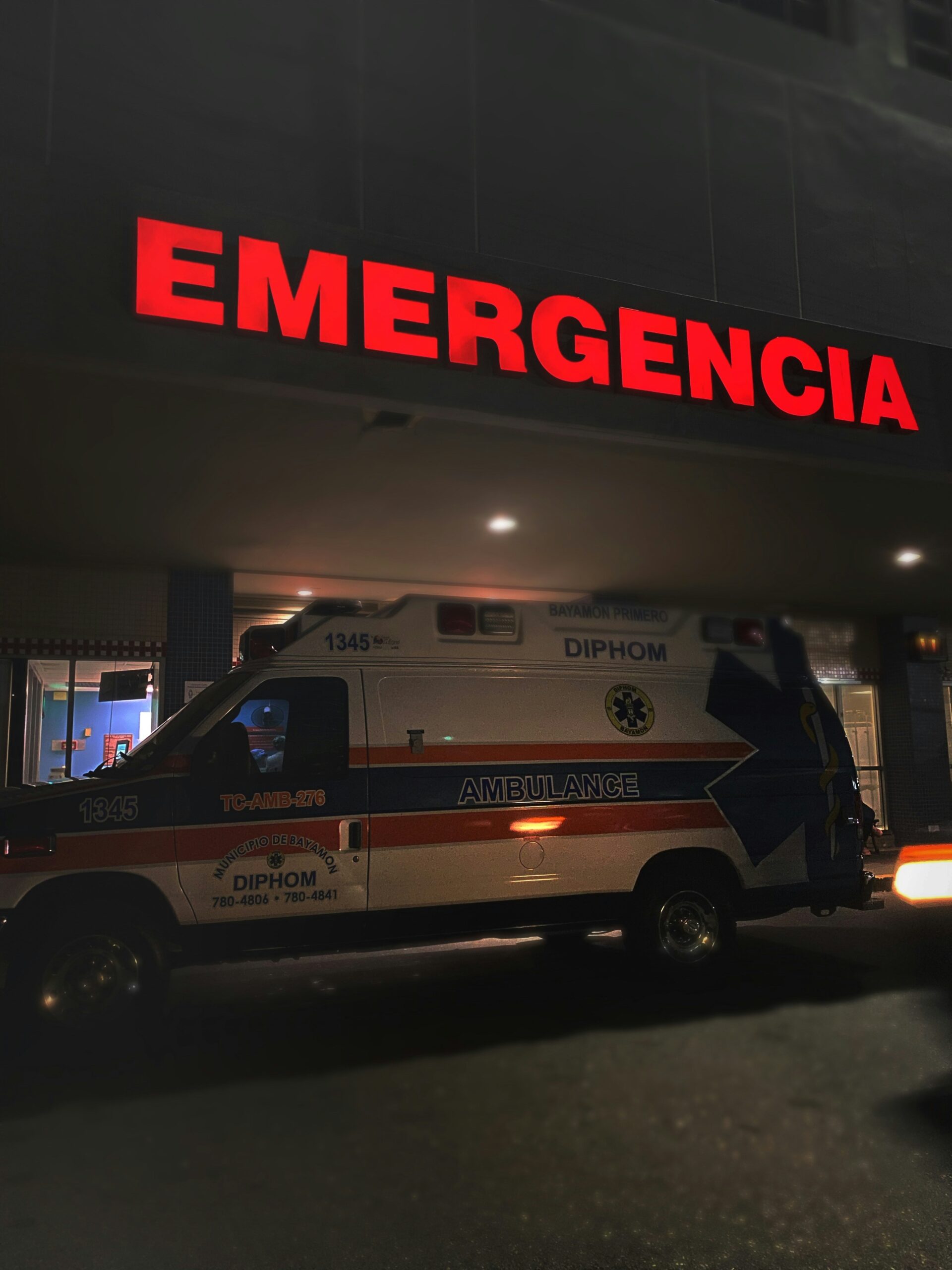

An emergency fund is an essential component of personal financial planning. This unique savings account is specifically designed to cover unexpected expenses arising from unforeseen circumstances. Situations such as medical emergencies, significant car repairs, sudden unemployment, or urgent home repairs are prime examples of financial disruptions that may necessitate the utilization of an emergency fund.

The primary characteristic of an emergency fund is its liquidity. Liquidity refers to the ease with which assets can be converted into cash without significant loss of value. In the case of an emergency fund, having easily accessible cash is crucial. This means the funds should be held in accounts that provide immediate or near-immediate access, such as high-yield savings accounts or money market accounts. The goal is to ensure that money is readily available when it is most needed, without being tied up in investment instruments that may take time to liquidate or incur penalties for early withdrawal.

Another key aspect of an emergency fund is its accessibility. Unlike other types of savings or investments that may be earmarked for long-term goals, emergency funds are set aside solely for urgent, unplanned expenses. Therefore, the ease of access is paramount. Having funds in a secure but easily retrievable form ensures that when emergencies arise, they can be addressed promptly without the added stress of financial maneuvering.

Establishing an emergency fund is a fundamental element of comprehensive financial planning. It acts as a financial buffer, protecting individuals and families from resorting to high-interest debt options such as credit cards or personal loans. By ensuring an emergency fund is in place, one can navigate financial crises with greater confidence and stability. Thus, an emergency fund serves not only as a financial lifeline but also as a means to maintain peace of mind and long-term financial health.

Why You Need an Emergency Fund

An emergency fund acts as a financial safety net, providing crucial support during unforeseen challenges. One of the primary reasons for establishing an emergency fund is the unexpected job loss, which can severely disrupt your financial stability, especially if you lack alternative income sources. Having funds set aside allows you to manage your living expenses while you search for new employment, thereby easing the financial strain typically associated with job loss.

Medical emergencies are another significant scenario where an emergency fund proves invaluable. Despite health insurance, out-of-pocket costs for serious medical conditions or surgeries can be substantial. An emergency fund provides the necessary financial cushion to manage these expenses without resorting to high-interest debt or compromising your other financial goals.

In addition, major car repairs can arise unexpectedly, creating immediate financial demands. Whether it’s a transmission failure or significant engine work, such repairs can be costly. An emergency fund ensures that you can cover these expenses and maintain your mobility without affecting your other financial commitments.

Urgent home repairs, such as fixing a leaking roof, replacing a broken furnace, or addressing plumbing issues, also underscore the need for emergency savings. These repairs are often unavoidable and delaying them could lead to more extensive and expensive damage. An emergency fund provides the financial means to tackle these issues promptly, maintaining the integrity and livability of your home.

Apart from these tangible benefits, the psychological advantages of having an emergency fund are significant. Financial security reduces stress and anxiety, offering peace of mind. Knowing that you have a buffer against life’s uncertainties allows you to focus more on other aspects of your life, boosting overall well-being.

How Much Should You Save?

Determining the appropriate amount to save in an emergency fund is crucial for financial security. A broadly recommended guideline suggests saving an amount equivalent to three to six months’ worth of living expenses. This duration provides a sufficient cushion to cover unexpected events such as job loss, medical emergencies, or substantial household repairs without disrupting your financial stability.

However, this general rule should be tailored to fit individual circumstances. For instance, if you have a high degree of job stability, you might opt for the lower end of the spectrum and aim for three months’ worth of expenses. Conversely, individuals with fluctuating income or those working in volatile industries might consider saving closer to six months or even more, ensuring that they can support themselves during prolonged periods of uncertainty.

Family size also plays a critical role in determining the adequate size of an emergency fund. Larger families typically incur higher monthly obligations for essentials like food, utilities, and healthcare, necessitating a more substantial reserve. On the other hand, single individuals or smaller households may find that a slightly smaller fund suffices.’

Additionally, regular reassessments of your financial goals and obligations are prudent. Life circumstances and expenses change over time, so periodically reviewing and adjusting the amount in your emergency fund is essential. Annual evaluations are a good practice, allowing you to account for any new responsibilities, changes in income levels, or shifts in fixed monthly expenditures.

Ultimately, constructing and maintaining a robust emergency fund is a personalized process. The goal is to create a financial buffer that can support your specific lifestyle and financial commitments in the face of unforeseen challenges. By considering various factors and adapting your savings strategy accordingly, you can ensure that your emergency fund will truly serve as a financial lifesaver when needed.

Building Your Emergency Fund: Strategies and Tips

Creating an emergency fund is a cornerstone of financial stability, providing a buffer against unexpected expenses and economic downturns. Start by setting clear savings goals. Determine the amount needed for 3-6 months of essential living expenses. With a specific target in place, the next step is to create a systematic approach to meet this goal.

Automating your savings is a highly effective strategy. Set up automatic transfers from your checking account to a dedicated emergency fund account. This method ensures consistency and reduces the temptation to skip or delay contributions. Even modest, regular deposits can accumulate significantly over time, so don’t underestimate the power of small, automatic transfers.

Another vital strategy is to critically evaluate and reduce discretionary spending. Analyze your monthly expenses and identify non-essential items that can be trimmed. Dining out, entertainment subscriptions, and impulse buys are common areas where cuts can be made. Redirecting this saved money into your emergency fund accelerates its growth and builds financial resilience.

Additionally, consider funneling any windfalls directly into your emergency fund. Bonuses, tax refunds, or unexpected gifts can substantially boost your savings. By treating these extras as opportunities to fortify your financial safety net rather than an excuse for discretionary spending, you bolster your emergency fund rapidly and efficiently.

Staying motivated throughout the saving process is paramount. Regularly revisiting your financial goals and reminding yourself of the security that an emergency fund provides can help maintain discipline. Establish milestones and celebrate small victories to keep the momentum going. Visual aids like progress charts can also offer a tangible sense of achievement, making the abstract concept of saving more concrete and motivating.

Building an emergency fund requires strategic planning and steadfast discipline. By automating savings, reducing discretionary expenses, and redirecting financial windfalls, you can effectively create a financial cushion that safeguards against life’s uncertainties.

Choosing the Right Account for Your Emergency Fund

When it comes to securing your emergency fund, selecting the right type of account is crucial. Various options are available, including high-yield savings accounts, money market accounts, and short-term certificates of deposit (CDs). Each account type comes with its own set of advantages and disadvantages, which are essential to consider based on your financial goals and needs.

High-yield savings accounts are often recommended for emergency funds due to their combination of easy accessibility and competitive interest rates. These accounts typically offer significantly higher returns compared to traditional savings accounts, helping your money grow steadily while still being available for immediate withdrawal. However, it is essential to be aware of the withdrawal limits that might be imposed, as frequently exceeding these limits can lead to fees or restrictions.

Money market accounts offer another viable option. These accounts generally provide a competitive interest rate, which can be higher than that of standard savings accounts. Additionally, money market accounts often come with check-writing and debit card privileges, adding a layer of convenience for accessing your funds quickly. However, the minimum balance requirements for money market accounts are usually higher, which may not be suitable for everyone.

Short-term certificates of deposit (CDs) present a different approach to storing your emergency fund. While CDs typically offer higher interest rates compared to savings and money market accounts, they lock in your money for a fixed term, ranging from a few months to a few years. This can be beneficial for disciplined saving, but it also means that accessing your funds in the case of an emergency might incur penalties or fees.

In choosing the right account for your emergency fund, consider factors such as ease of access, interest rates, minimum balance requirements, and potential fees. By carefully evaluating each option, you can ensure that your emergency fund is not only secure but also optimized for growth, providing a financial safety net that meets your unique needs.

When to Use Your Emergency Fund

Determining the right moment to utilize your emergency fund can often be challenging. The essence of an emergency fund is to cover unforeseen expenses, but setting clear criteria can guide prudent decision-making. Understanding what constitutes a legitimate emergency versus a non-emergency can significantly impact your financial stability.

Legitimate emergencies typically encompass unexpected events that have an immediate and significant impact on your well-being or financial health. Examples include sudden medical expenses, urgent home repairs such as a leaking roof, or car repairs that are essential for your daily commute. Additionally, job loss or a significant reduction in income could warrant tapping into your emergency fund to cover living expenses temporarily.

Conversely, non-emergencies often involve expenses that, while perhaps unexpected, do not threaten your immediate financial stability. For instance, replacing a functional electronic device with a newer model or funding a last-minute vacation does not fall under the purview of emergencies. Though these situations may be compelling, they can typically be planned for over time or mitigated through other means.

When faced with an unexpected expense, a key factor to consider is whether the cost is essential and urgent. Assess if the expense is necessary for your immediate well-being or if it will have a long-term detrimental effect if not addressed. If the answer is yes, it may be justified to use your emergency fund. However, if the expense can be postponed or handled via alternative financial strategies, consider conserving your emergency fund for truly critical needs.

Prudence is vital when deciding to use your emergency fund. Overusing these savings for non-essential items can deplete your buffer, leaving you vulnerable to true emergencies. Striking a balance between addressing urgent needs and maintaining your financial cushion requires thoughtful consideration of each situation. By carefully discerning and planning, you can ensure your emergency fund remains an effective financial lifesaver.

Replenishing Your Emergency Fund

After utilizing an emergency fund due to unforeseen circumstances, the immediate goal should be to replenish it swiftly. Maintaining a fully-funded emergency account ensures financial stability and preparedness for future unexpected events. But how is this accomplished effectively?

Firstly, reassess and adjust your budget. This step involves closely examining your income and expenses to identify areas where costs can be minimized. Consider reducing discretionary spending such as dining out, entertainment, and other non-essential purchases. Redirecting these savings into your emergency fund will expedite its replenishment.

Secondly, consider reallocating funds from other savings goals. While it may seem counterproductive, temporarily diverting funds from other financial objectives—such as vacations, new gadgets, or even an investment account—can provide a significant boost to your emergency savings. Once the emergency fund is restored to its optimal level, you can then refocus on these secondary goals with renewed peace of mind.

Finally, increasing your savings contributions is a pivotal strategy. If possible, boost the amount you regularly deposit into your emergency fund. This can be achieved either by increasing the percentage of your income allocated to savings or by capitalizing on additional sources of income, such as freelance work or part-time jobs. The key lies in prioritizing the replenishment of your emergency resources over expanding other savings during this period.

Maintaining a well-funded emergency account is of paramount importance. Not only does it safeguard against financial distress during crises, but it also fosters a sense of financial security and readiness. By adopting these strategies of budget adjustment, fund reallocation, and increased savings, you can ensure that your emergency fund remains a robust safety net for the future.

Emergency Funds: Common Mistakes to Avoid

Establishing an emergency fund is a vital step in sound financial planning, yet many individuals fall prey to common mistakes that undermine the effectiveness of this financial safety net. One prevalent error is underfunding the account. Ideally, an emergency fund should cover three to six months’ worth of living expenses. However, many people underestimate their actual costs, leading to an insufficient buffer during times of crisis. To avoid this, meticulously calculate your monthly expenses, including rent, groceries, utilities, and other necessities, and then aim to save an amount that would sustain you for half a year under unforeseen circumstances.

Another significant mistake is using the emergency fund for non-emergencies. While it might be tempting to dip into this reserve for a vacation, a new gadget, or home improvements, doing so jeopardizes your financial security. Reserve the emergency fund strictly for genuine emergencies, such as urgent medical expenses, unexpected job loss, or major home repairs that are crucial for safe living. Clearly defining what constitutes an ’emergency’ for your household can help maintain this discipline.

Failing to keep the emergency fund replenished is also a critical oversight. After using part of your emergency savings, it’s imperative to restore the fund to its previous level as quickly as possible. This can be achieved by resuming regular deposits, even if they are small, until the fund is fully replenished. Treat it as a non-negotiable budget item each month to ensure that the emergency fund remains an unfailing financial safeguard.

Practical strategies like automating transfers to your emergency fund or setting up separate accounts specifically for emergencies can significantly enhance your ability to save and maintain financial discipline. By avoiding these common mistakes and implementing rigorous practices, an emergency fund can indeed serve its purpose as a robust financial lifeline.